Table of Contents

- Introduction

- India vs U.S. Stock Market Size

- Key Stock Exchanges in India and U.S.

- Stock Trading Hours

- Stock Market Regulation

- Stock Investment Options

- Stock Market Volatility

- Taxation in Stock Markets

- Trading Technology and Platforms

- Stock Market Liquidity

- Investor Demographics in Stock Markets

- FAQs

- Disclaimer

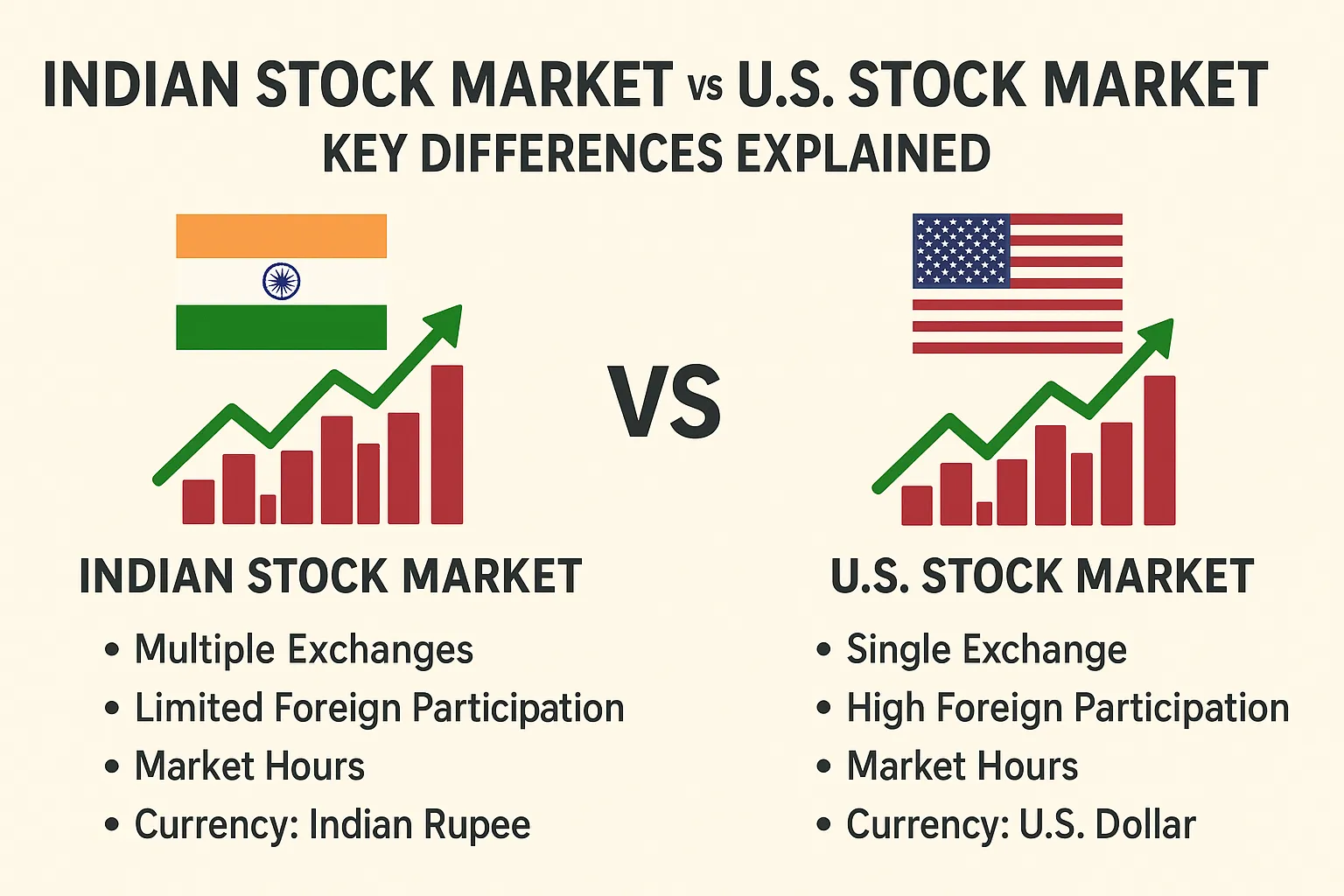

Introduction to India Stock vs U.S. Stock Market

Exploring the **India stock vs U.S. stock market** reveals critical differences in structure, regulations, and investment opportunities. For instance, the **Indian stock market**, led by the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE), is expanding rapidly, fueled by growing domestic participation and a dynamic economy. Meanwhile, the **U.S. stock market**, dominated by the New York Stock Exchange (NYSE) and NASDAQ, is the world’s largest, drawing global capital with its advanced infrastructure. This article dives into the **Indian stock market vs U.S. stock market** to guide smarter investment decisions.

Moreover, distinctions in trading hours and regulations, such as **NSE vs NYSE** and **BSE vs NASDAQ**, create unique investor experiences. Specifically, the **India stock vs U.S. stock market** comparison highlights that trading in India, regulated by the Securities and Exchange Board of India (SEBI), emphasizes high-growth sectors like technology and pharmaceuticals with shorter trading hours. In contrast, the **U.S. stock market**, overseen by the Securities and Exchange Commission (SEC), provides extended trading sessions and diverse options, from tech giants to startups. Thus, this article examines the **India stock vs U.S. stock market** to empower investors.

p>

India Stock vs U.S. Stock Market

By analyzing market dynamics, risks, and opportunities, we outline key differences in the **India stock vs U.S. stock market**, covering regulations, trading hours, and investment options. Ultimately, you’ll gain insights for informed investing.

India vs U.S. Stock Market Size

- The **U.S. stock market** leads globally with a market capitalization exceeding $50 trillion.

- Companies like Apple, Microsoft, and Amazon dominate major indices.

- In contrast, the **Indian stock market** holds a market capitalization of around $3 trillion but ranks among the fastest-growing due to India’s expanding economy.

- Global investors view the **U.S. stock market** as safer and more liquid, whereas the **Indian stock market** offers high growth potential in technology, pharmaceuticals, and renewable energy.

Key Stock Exchanges in India and U.S.

India

- NSE (National Stock Exchange): Technologically advanced with high trading volumes.

- BSE (Bombay Stock Exchange): Asia’s oldest exchange, renowned for the Sensex index.

U.S.

- NYSE (New York Stock Exchange): Specializes in large-cap stocks with traditional trading floors.

- NASDAQ: Tech-focused, electronic trading platform hosting global tech giants.

Stock Trading Hours

- In India, the **Indian stock market** operates from 9:15 AM to 3:30 PM IST, Monday to Friday.

- Conversely, the **U.S. stock market**, including NYSE and NASDAQ, runs from 9:30 AM to 4:00 PM EST, Monday to Friday, with pre-market and after-hours trading.

- Due to the time difference, Indian investors can trade **U.S. stocks** during night hours, facilitating global diversification.

Stock Market Regulation

- In the **Indian stock market**, SEBI ensures transparency, investor protection, and fraud prevention.

- Similarly, the **U.S. stock market** is regulated by the SEC, enforcing strict rules for trading, financial reporting, and investor safety.

Stock Investment Options

- The **Indian stock market** offers stocks, ETFs, mutual funds, derivatives (futures and options), and IPOs.

- In comparison, the **U.S. stock market** provides similar options plus REITs, bonds, options, futures, and global ETFs.

- While the **U.S. stock market** offers more diversified products, the **Indian stock market** emphasizes high-growth domestic sectors.

Stock Market Volatility

- The **Indian stock market** experiences higher volatility due to emerging economy risks, currency fluctuations, and political factors.

- Meanwhile, the **U.S. stock market** remains relatively stable but can face volatility during economic crises, interest rate changes, or global events.

Taxation in Stock Markets

- In the **Indian stock market**, a 10% dividend distribution tax applies, alongside capital gains tax based on holding period.

- Conversely, the **U.S. stock market** taxes long-term capital gains at 0%–20% based on income, with short-term gains taxed at ordinary income rates.

- Consequently, tax policies significantly influence investment decisions in both **Indian and U.S. stock markets**.

Trading Technology and Platforms

- The **U.S. stock market** leverages advanced technology, including high-frequency trading, AI-based analytics, and robust platforms.

- Likewise, the **Indian stock market** has modernized rapidly with apps like Zerodha, Upstox, and ICICI Direct, enhancing trading accessibility.

Stock Market Liquidity

- The **U.S. stock market** enjoys high liquidity due to strong participation from retail and institutional investors.

- Although the **Indian stock market** has improving liquidity, it still faces lower market depth, making large-volume trades more challenging.

Investor Demographics in Stock Markets

- The **U.S. stock market** attracts a global investor base, including hedge funds, pension funds, and foreign retail investors.

- In contrast, the **Indian stock market** remains primarily domestic-focused but increasingly draws foreign institutional investors (FIIs).

FAQs

- Can Indian investors trade in the **U.S. stock market**? Yes, through platforms like Interactive Brokers, Vested, or INDmoney.

- Which is safer, **Indian stock market vs U.S. stock market**? The **U.S. stock market** is considered safer due to robust regulation and liquidity, while the **Indian stock market** offers growth with higher risk.

- How are dividends taxed in both markets? **Indian stock market**: 10% dividend distribution tax. **U.S. stock market**: Taxed per income bracket, often with withholding tax for foreign investors.

- Which market is better for long-term investment? Both **Indian and U.S. stock markets** suit long-term investing; the U.S. offers stability, while India provides growth potential.

- Are IPOs more profitable in **Indian or U.S. stock markets**? **Indian stock market** IPOs often yield high short-term gains, whereas **U.S. stock market** IPOs focus on long-term wealth creation.

Disclaimer

This article is for educational purposes and is not financial advice. Stock investing carries risks, including the loss of capital. Always research thoroughly or seek advice from a licensed financial advisor before investing.

Learn more about investing in US stocks from India, cryptocurrency and blockchain, or de-dollarization in 2025.

For additional insights, visit Investopedia.