Table of Contents

- Introduction

- What Are Stocks?

- What Are Mutual Funds?

- Mutual Funds vs Stocks: Key Comparison

- Returns Comparison (2020–2025)

- Who Should Invest in Stocks in 2025?

- Who Should Invest in Mutual Funds in 2025?

- Mutual Funds vs Stocks: Taxation in 2025

- Mutual Funds vs Stocks: Which Is Better in 2025?

- Expert Tips for 2025

- Related Topics

- FAQs: Mutual Funds vs Stocks in 2025

- Conclusion

Introduction

Are you wondering whether to invest in mutual funds or stocks in 2025? With changing market conditions, new tax rules, and emerging investment options, choosing the best investment has become more challenging than ever. In this article, we’ll compare mutual funds vs stocks based on returns, risk, tax benefits, and suitability, helping you decide the right option for your financial goals.

What Are Stocks?

Stocks represent ownership in a company. When you buy a share, you become a partial owner of that company. When the company grows and performs well, your investment value increases through share price appreciation, and you may also earn dividends as a reward for holding its stock.

Key Features of Stocks:

- Direct ownership in a company

- High return potential but also high risk

- Requires active monitoring

- Best for investors who can analyze markets

Example: Buying 10 shares of Reliance at ₹2,500 each makes you a shareholder. If the stock rises to ₹3,000, you earn ₹500 per share.

What Are Mutual Funds?

Mutual funds pool money from multiple investors and invest in a diversified portfolio of stocks, bonds, or other securities. A professional fund manager handles investments on your behalf.

Key Features of Mutual Funds:

- Managed by experts

- Diversified portfolio → reduced risk

- Systematic Investment Plans (SIPs) make investing easier

- Suitable for beginners and passive investors

Example: If you invest ₹5,000 monthly in an SIP, your money is automatically diversified across several companies and sectors.

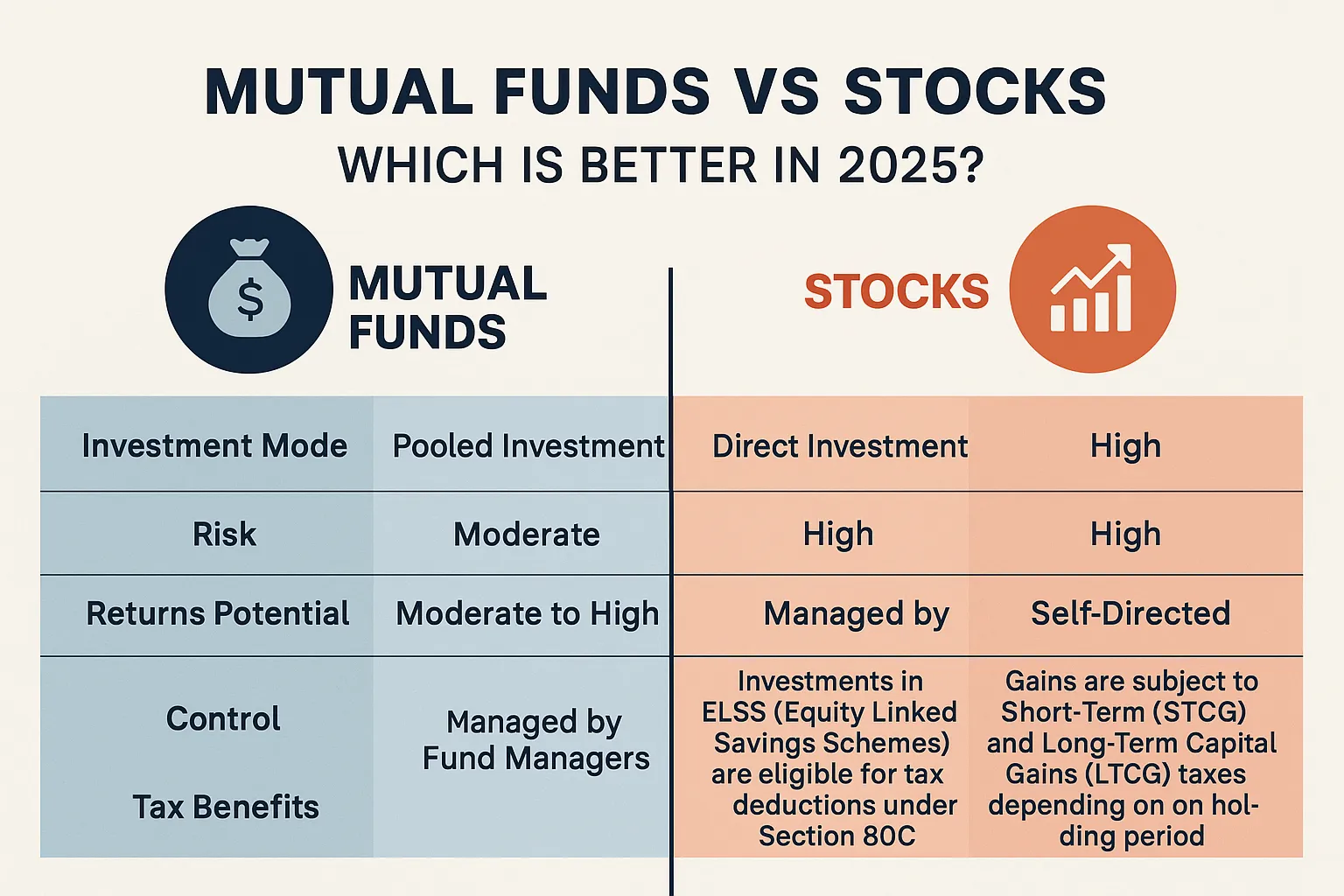

Mutual Funds vs Stocks: Key Comparison

| Feature | Stocks | Mutual Funds |

|---|---|---|

| Risk | High – depends on individual stock | Moderate – diversified portfolio |

| Returns | Can be very high but volatile | Stable but slightly lower |

| Expert Management | You manage your investments | Managed by professional fund managers |

| Investment Amount | Lump sum or as you choose | SIP starts as low as ₹500 |

| Tax Benefits | No specific tax benefits | ELSS mutual funds offer tax benefits under Section 80C |

| Liquidity | High – sell anytime | High but subject to exit load |

| Best For | Active traders & market experts | Beginners & passive investors |

Returns Comparison (2020–2025)

Here’s a look at average returns from stocks and mutual funds over the last five years:

| Year | Nifty 50 Stocks (%) | Equity Mutual Funds (%) |

|---|---|---|

| 2020 | -14% | -10% |

| 2021 | +24% | +20% |

| 2022 | +10% | +8% |

| 2023 | +18% | +15% |

| 2024 | +12% | +11% |

Observation:

- Stocks outperform in bull markets but fall sharply in bear phases.

- Mutual funds smooth out volatility due to diversification.

Who Should Invest in Stocks in 2025?

- Risk tolerance: High

- Time to manage portfolio: Yes

- Goal: Higher returns in shorter duration

- Knowledge level: Experienced investors

Pro Tip: Use stop-loss orders and diversify across sectors to minimize risk.

Who Should Invest in Mutual Funds in 2025?

- Risk tolerance: Low to moderate

- Time to manage portfolio: Limited

- Goal: Wealth creation over long term

- Knowledge level: Beginners or busy professionals

Pro Tip: Prefer SIP investments in equity mutual funds for long-term wealth creation.

Mutual Funds vs Stocks: Taxation in 2025

| Investment Type | Holding Period | Tax Type | Tax Rate |

|---|---|---|---|

| Stocks | < 1 year | STCG | 15% |

| Stocks | ≥ 1 year | LTCG | 10% (above ₹1L) |

| Equity Mutual Funds | < 1 year | STCG | 15% |

| Equity Mutual Funds | ≥ 1 year | LTCG | 10% (above ₹1L) |

| Debt Mutual Funds | < 3 years | STCG | Slab rate |

| Debt Mutual Funds | ≥ 3 years | LTCG | 20% with indexation |

Mutual Funds vs Stocks: Which Is Better in 2025?

| Criteria | Winner |

|---|---|

| Risk Management | Mutual Funds |

| Returns Potential | Stocks |

| Beginner-Friendly | Mutual Funds |

| Tax Saving Options | Mutual Funds (ELSS) |

| Control | Stocks |

Final Verdict:

- If you want higher but volatile returns, go for stocks.

- If you prefer safer, steady growth, mutual funds are better.

- A balanced portfolio with both is the smartest strategy for 2025.

Expert Tips for 2025

- Start with a 60:40 mix → 60% mutual funds + 40% stocks.

- Use SIPs for disciplined investing.

- Invest in blue-chip stocks for stability.

- Rebalance your portfolio every 6-12 months.

- Avoid chasing “hot tips” and focus on fundamentals.

Related Topics

Explore more investment insights:

Cryptocurrency and Blockchain: Disrupting Investment Models

FAQs: Mutual Funds vs Stocks in 2025

1. Are mutual funds safer than stocks in 2025?

Yes, mutual funds are generally safer due to diversification and professional management.

2. Which gives higher returns — SIP or stocks?

Stocks can offer higher returns, but SIPs in equity mutual funds provide steady, long-term growth with lower risk.

3. Can I invest in both mutual funds and stocks?

Absolutely! A balanced portfolio combining both helps maximize returns while reducing risks.

4. Are mutual funds a good investment choice for beginners in 2025?

Yes. Equity mutual funds via SIPs are one of the best investment options for beginners.

5. Which is better for tax saving — mutual funds or stocks?

ELSS mutual funds under Section 80C provide tax benefits. Stocks do not.

Conclusion

In 2025, there’s no single winner in the mutual funds vs stocks debate. The suitability depends on how much risk you can handle, your financial goals, and how long you plan to invest. For most investors, a combination of both works best: mutual funds for stability and stocks for growth.

Pro Investing Tip: Start early, stay consistent, and diversify wisely. That’s the formula for financial success.

Useful External Resource: For more details, visit the

SEBI Mutual Funds Guide

.

Disclaimer: This article is only for learning and information purposes. It’s not financial or investment ad