When it comes to investing, the debate of real estate vs stock market is one of the most common questions investors face. The best choice depends on your financial goals, risk tolerance, time commitment, and investment horizon. Both asset classes offer unique opportunities for building wealth, but they also come with distinct advantages, risks, and operational demands. This comprehensive guide explores the pros and cons of each, provides actionable insights, and answers common questions to help you determine the optimal investment strategy.

Real Estate vs. Stock Market: Where Should You Invest?

Table of Contents

- Understanding Real Estate Investing

- Pros of Real Estate Investing

- Cons of Real Estate Investing

- Understanding Stock Market Investing

- Pros of Stock Market Investing

- Cons of Stock Market Investing

- Real Estate vs. Stock Market: Key Comparisons

- Blending Real Estate and Stocks: REITs

- Strategic Considerations

- Frequently Asked Questions (FAQs)

- Conclusion: Building Wealth

- Disclaimer

Real Estate vs. Stock Market

Understanding Real Estate Investing

Real estate investing involves purchasing physical properties—such as residential homes, commercial buildings, or vacant land—with the aim of generating returns through rental income, property appreciation, or both. Real estate is often viewed as a cornerstone of wealth-building due to its tangible nature and potential for steady cash flow.

Pros of Real Estate Investing

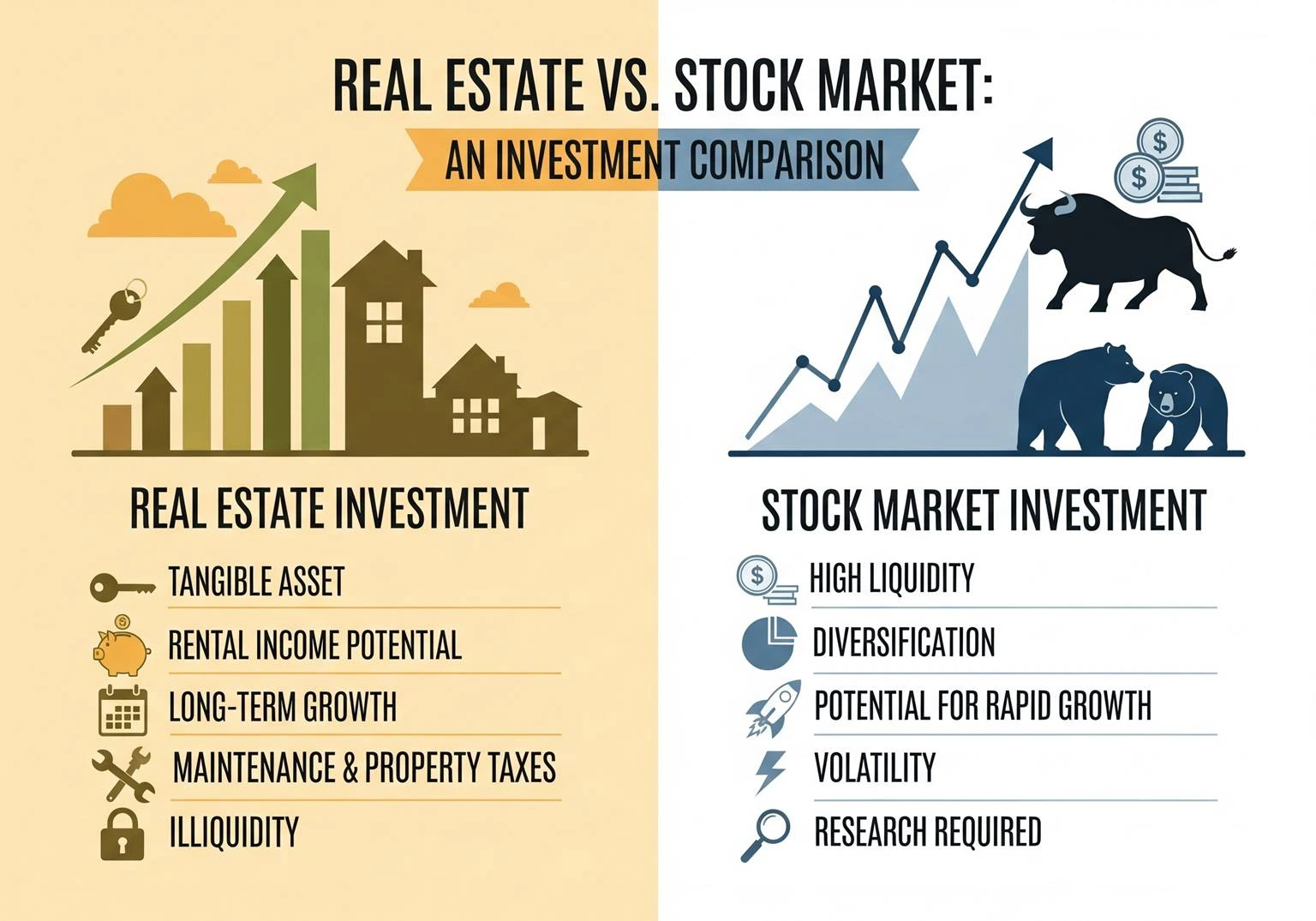

- Tangible Asset: Real estate is a physical asset you can see and touch, unlike stocks, which exist as digital or paper certificates. This tangibility provides a sense of security for many investors, especially during economic uncertainty.

- Passive Income through Cash Flow: Rental properties can generate consistent monthly income, covering expenses like mortgages, property taxes, and maintenance while potentially yielding a profit. For example, a well-managed rental property in a high-demand area can provide reliable passive income.

- Leverage for Wealth Creation: Real estate allows you to use leverage, meaning you can control a high-value asset with a relatively small down payment (e.g., 15–20% of the property’s value). This amplifies your potential returns, as you benefit from the appreciation of the entire property, not just your initial investment.

- Inflation Hedge: Property values and rental rates typically rise with inflation, making real estate a strong hedge against the increasing cost of living.

- Tax Advantages: Real estate investors can benefit from numerous tax deductions, including mortgage interest, property taxes, insurance, maintenance costs, and depreciation. These deductions can significantly reduce taxable income, enhancing overall returns.

- Control Over Investment: Unlike stocks, where you have little influence over company decisions, real estate allows you to make strategic choices—such as upgrading properties or adjusting rental rates—to boost value and income.

Cons of Real Estate Investing

- High Initial Costs: Entering the real estate market requires substantial capital for down payments, closing costs, and potential renovations. For instance, a $300,000 property might demand a $60,000 down payment, which can be a barrier for new investors.

- Illiquidity: Real estate is not a liquid asset. Selling a property can take weeks or months, and transaction costs—such as realtor commissions (typically 5–6%) and legal fees—can erode profits.

- Active Management Requirements: Managing a rental property often involves hands-on tasks like tenant screening, maintenance, and handling vacancies. While hiring a property manager can reduce this burden, it typically costs 8–12% of monthly rental income.

- Concentration Risk: Diversifying a real estate portfolio is challenging due to high costs. Most investors own only one or a few properties, exposing them to risks tied to local market conditions, such as economic downturns or neighborhood-specific issues.

- Market Volatility: While real estate is generally less volatile than stocks, it’s not immune to market fluctuations. The 2008 housing crisis demonstrated how property values can plummet, leaving investors with depreciated assets.

Understanding Stock Market Investing

Stock market investing involves purchasing shares of publicly traded companies, representing partial ownership in those businesses. Returns are generated through capital gains (rising stock prices) and dividends (periodic payments to shareholders). The stock market is a cornerstone of modern investing due to its accessibility and historical performance.

Pros of Stock Market Investing

- High Liquidity: Stocks are highly liquid, allowing you to buy or sell shares instantly during market hours. This flexibility is great for investors who need to access their money quickly.

- Low Barrier to Entry: With modern brokerage platforms offering commission-free trading and fractional shares, you can start investing with as little as $10. This makes the stock market accessible to beginners and those with limited capital.

- Diversification Opportunities: The stock market enables easy diversification through index funds or Exchange-Traded Funds (ETFs), which spread your investment across multiple companies, industries, and regions. For example, an S&P 500 ETF provides exposure to 500 major U.S. companies, reducing individual company risk.

- Passive Investing: Stock market investments require minimal upkeep. Once you’ve built a diversified portfolio, you can let it grow without the hands-on management needed for real estate.

- Historical Returns: Over the long term, the stock market has delivered average annual returns of approximately 7–10% after inflation, outpacing real estate in many periods. The power of compounding can significantly grow your wealth over decades.

- Accessibility: With advancements in robo-advisors and low-cost trading platforms, investing in stocks has never been easier. Apps like Robinhood, Fidelity, or Vanguard allow seamless portfolio management from your phone.

Cons of Stock Market Investing

- Short-Term Volatility: Stocks are prone to significant price swings driven by economic data, corporate earnings, or global events. For instance, the S&P 500 experienced a 19% drop in 2022 due to inflation fears, which can unsettle risk-averse investors.

- Limited Control: As a shareholder, you have no direct influence over a company’s operations or strategic decisions. Your returns depend on management performance and broader market trends.

- Emotional Investing Risks: The ease of trading stocks can lead to impulsive decisions, such as selling during a market dip or chasing trending stocks, which can harm long-term returns.

- Tax Considerations: Capital gains from stocks are taxable, with short-term gains (held less than a year) taxed at higher ordinary income rates. However, tax-advantaged accounts like IRAs or 401(k)s can mitigate this.

- No Tangible Asset: Unlike real estate, stocks are intangible, which can feel less secure for some investors, especially during market downturns.

Real Estate vs. Stock Market: Key Comparisons

| Factor | Real Estate | Stock Market |

|---|---|---|

| Entry Cost | High (down payment, closing costs) | Low (fractional shares, no minimums) |

| Liquidity | Low (weeks/months to sell) | High (sell instantly during market hours) |

| Management | Active (tenant issues, maintenance) | Passive (minimal upkeep) |

| Diversification | Difficult (high cost per property) | Easy (index funds, ETFs) |

| Returns | Steady cash flow, 4–8% appreciation | 7–10% average annual returns (long-term) |

| Risk | Local market risks, leverage risks | Short-term volatility, market risks |

| Tax Benefits | Deductions (mortgage interest, depreciation) | Tax-advantaged accounts (IRA, 401(k)) |

Blending Real Estate and Stocks: REITs

For investors seeking the benefits of both asset classes, Real Estate Investment Trusts (REITs) offer a compelling solution. REITs are companies that own and operate income-producing real estate, such as apartment complexes, office buildings, or shopping centers. They trade like stocks on major exchanges, combining the liquidity of stocks with the income potential of real estate.

Benefits of REITs

- Accessibility: You can invest in REITs with small amounts, similar to stocks.

- Dividends: REITs are required to distribute at least 90% of their taxable income as dividends, providing steady income.

- Diversification: REITs often hold diverse portfolios of properties across regions and sectors.

- Liquidity: Like stocks, REITs can be bought or sold instantly during market hours.

Real Estate vs. Stock Market

Drawbacks of REITs

- Market Volatility: REITs are subject to stock market fluctuations, unlike direct real estate.

- Tax Implications: REIT dividends are often taxed as ordinary income, which may be higher than capital gains rates.

Popular REITs include Vanguard Real Estate ETF (VNQ) and Prologis (PLD), which focus on diversified and industrial properties, respectively.

Real Estate vs. Stock Market

Strategic Considerations

Economic Context

Economic factors like interest rates, inflation, and housing demand play a significant role. High interest rates may increase borrowing costs for real estate, potentially cooling property price growth. Conversely, stocks may face volatility due to global uncertainties, but sectors like technology and healthcare continue to show resilience. Learn more about how inflation and interest rates affect global real estate markets.

Personal Financial Goals

- Short-Term Goals (1–5 years): The stock market’s liquidity makes it ideal for shorter horizons, especially via diversified ETFs.

- Long-Term Goals (10+ years): Both real estate and stocks can excel, but real estate’s leverage and tax benefits may appeal to those willing to manage properties.

- Risk Tolerance: If market swings cause anxiety, real estate’s stability might be preferable. If you’re comfortable with volatility, stocks offer higher long-term returns.

Diversification Strategy

Rather than choosing one over the other, a balanced portfolio combining real estate, stocks, and REITs can mitigate risks and maximize returns. For example:

- Allocate 60% to stocks (e.g., S&P 500 ETF) for growth and liquidity.

- Allocate 20% to REITs for real estate exposure without management hassles.

- Allocate 20% to direct real estate (if capital allows) for cash flow and tax benefits.

Frequently Asked Questions (FAQs)

- Which is better for beginners: real estate or stocks?

Stocks are generally better for beginners due to their low entry cost, ease of diversification, and passive nature. You can start with small amounts through ETFs or fractional shares, whereas real estate requires significant capital and active management. - Can I invest in real estate without buying property?

Yes, Real Estate Investment Trusts (REITs) allow you to invest in real estate without owning physical property. REITs trade like stocks and provide exposure to real estate markets with lower costs and greater liquidity. - How much capital is required to begin investing in real estate?

The amount varies by location and property type, but a typical down payment is 15–20% of the property’s value (e.g., $45,000–$60,000 for a $300,000 property). Additional costs include closing fees, renovations, and ongoing maintenance. - Are stocks riskier than real estate?

Stocks are generally more volatile in the short term, with prices fluctuating daily. Real estate is less liquid but can be exposed to local market risks and economic downturns, as seen in the 2008 housing crisis. - How can I diversify my investments across both asset classes?

Consider a mix of stocks, REITs, and direct real estate (if feasible). For example, invest in low-cost index funds for stock exposure, REITs for real estate income, and a rental property for cash flow and tax benefits. - What are the tax benefits of real estate vs. stocks?

Real estate offers deductions for mortgage interest, property taxes, depreciation, and maintenance costs. Stocks offer tax-advantaged accounts like IRAs, where gains can grow tax-free or tax-deferred, but dividends and capital gains are taxable outside these accounts.

Conclusion: Building Wealth

Real estate and the stock market each offer unique paths to wealth, and the best choice depends on your circumstances. Real estate suits those with significant capital, a tolerance for active management, and a desire for tangible assets and passive income. The stock market is ideal for those seeking low-cost entry, high liquidity, and passive growth with strong historical returns. REITs bridge the gap, offering real estate benefits with stock-like flexibility.

To make an informed decision:

- Assess your financial situation: How much capital can you invest, and what’s your risk tolerance?

- Define your goals: Are you prioritizing income, growth, or both?

- Consider hybrid strategies: Blend stocks, REITs, and real estate for diversification.

By aligning your investments with your goals and leveraging the strengths of both asset classes, you can build a robust portfolio that thrives. For further insights, explore resources like Investopedia or consult a financial advisor to tailor your strategy.

Disclaimer

The information provided in this guide is for educational purposes only and does not constitute financial, legal, or tax advice. Investing in real estate and the stock market involves risks, including the potential loss of principal. Past performance is not indicative of future results. Always conduct thorough research and consult with a qualified financial advisor or tax professional before making investment decisions. Economic conditions, market trends, and tax laws may change, impacting the suitability of these investments. The author and publisher are not responsible for any financial losses or damages resulting from the use of this information.

Explore related topics: